Table of Content

Although this is a disadvantage, all loans require some sort of mortgage default insurance if the down payment is less than 20%, therefore, this is a factor that affects all loans. Another disadvantage is that 1% of home value is required as an upfront cash contribution as part of the down payment. This can be difficult for individuals that do not have savings, especially cash liquidity. Making them ideal for new homeowners who dont have an excellent credit score or large down payments available. Several federal government programs are designed for people who have low credit scores or limited cash for a down payment.

There aren't a ton of homes on the market, so buyers have time to weigh their options. You must undergo a preapproval evaluation from a Good Neighbor Next Door agent. Discounts are also handed out following a random lottery when multiple eligible people apply for a single listing. However, not all areas in the Empire State house enough of these professionals. To change that, The Department of Housing and Urban Development created the Good Neighbor Next Door Program .

Private mortgage insurance (PMI)

Today, SONYMA manages the Neighborhood Revitalization Program to help you buy homes after foreclosure. Plus, SONYMA lets you combine this loan with an Achieving the Dream mortgage. Achieving the Dream offers a low down payment and a discounted interest rate to lower-income borrowers. SONYMA has two mainstream down payment assistance loans that are available statewide.

If there are fewer houses on the market, you might have to adjust your expectations. Next, consider home values in the neighborhood you're considering. As of 2022, you can receive up to $101,574 for a SAH grant and $20,376 for a SHA grant.

Must Be A First Time Buyer

However, Veterans Affairs loans don't require down payment at all. Buying a house in New York City can be intimidating to many first-time buyers given its expensive reputation. However, New York City has higher income and purchase price limits for first-time home buyers compared with other regions in the state to accommodate for its more expensive home prices. You must also satisfy SONYMA's income and purchase price limitations, but you don't have to take a mortgage out through SONYMA.

First-time homebuyers are in a unique position to take advantage of lower interest rates, low down payment requirements, and down payment assistance. Being aware of the available options helps you step into a program that minimizes your upfront costs and your monthly mortgage payment. And that makes finding your dream home faster, simpler, and more affordable. The NHSNYC mortgage program provides affordable loans for both purchasing and refinancing homes within the New York City metropolitan area.

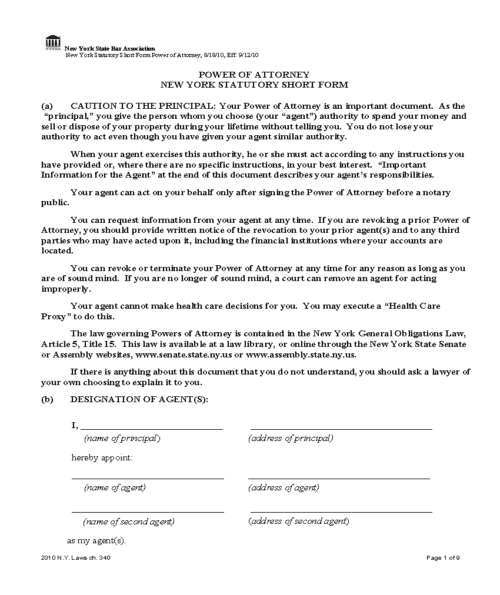

Legal and Government Services

This program is estimated to help reduce utility bills by 30% as compared to normal homes. Home buyer counseling from HomemartNY is required by all buyers. A cash contribution of 1% is required, however, the other 2% can come from gifts. If you are not a first-time home buyer, then a Military Veterans Eligibility Affidavit is required. 2-4 family homes must be at least 5 years old since the program application date and must have been used for residential purposes only.

The minimum assistance given is $1,000 the maximum is 3 percent of the purchase price up to $15,000, or $3,000, whichever is higher. If the property is sold, transferred, foreclosed on or no longer occupied before the 11th year of ownership, a portion of the grant may have to be repaid. Grant funds can only be used to buy a single or two-family home within the city of Lockport, and the purchase price cannot exceed $80,000. This program, administered by the Troy Rehabilitation and Improvement Program , offers up to a $20,000 grant for down payment and closing costs.

In New York, homeowners typically spend $3,705 in maintenance costs annually, but this can vary widely based on the house. In general, you should save 1% of the house’s value each year for repairs. If your dream house has been listed for that long, you shouldn't wait to submit an offer.

FHA.com's compilation is not a complete list, but it can serve as a starting point in your search for the down payment assistance program or grant for your situation. It is up to the consumer to contact these entities and find out the specifics of each program. The Nassau County Office of Housing and Community Development's First-time Homebuyer Downpayment Assistance Program helps make the mortgage process more affordable for eligible applicants. Competitive mortgage rates with low down payment requirements. Only 30-year fixed-rate mortgages are available as that is the only mortgage available under the Achieving the Dream and Low Interest Rate Program.

Low-to-moderate-income home buyers get a favorable interest rate in SONYMA’s Low Interest Rate Program — though published rates for the Achieving the Dream Program are even lower. SONYMA or HPD may well turn out to be your best bet for down payment assistance. But be sure to check out other homeownership programs in the area where you want to buy. SONYMA provides access to affordable homeownership by removing many of the hurdles faced by first-time homebuyers.

Additionally, this program is not limited to first-time home buyers. Existing homeowners can use the Conventional Plus loan to refinance their current mortgages, too. This grant program helps first-time buyers purchase a single-family home, condo or townhouse in the town of Colonie, village of Colonie and village of Menands.

It is not restricted to only first-time home buyers and can be used by anyone who wishes to purchase a home. The contingency reserves can go as high as 20% if recommended by an appraiser based on the condition of the home. The disadvantage is that the mortgage rate might be higher than other SONMYA programs like Achieving the Dream or Low Interest Rate program. More information regarding the FHA Plus Program can be found on the SONMYA Product Term Sheet. Credit Requirements – the loan requires a minimum credit score of 620, and non-traditional credit cannot be used.

No comments:

Post a Comment